HGTV’s original boss babe – Sandra Rinomato

After taking a turn as the host of Property Virgins and Buy Herself, Sandra Rinomato has come full circle putting her efforts back into Toronto area real estate.

After taking a turn as the host of Property Virgins and Buy Herself, Sandra Rinomato has come full circle putting her efforts back into Toronto area real estate.

Sandra Rinomato fell into a career in real estate almost by accident. It was the mid-90s, and the future TV star was considering opening up a coffee shop in the Toronto area. She reached out to a friend and commercial realtor for help to find a space, and he obliged. But he asked her an important question: Why did she want to work so hard?

“I said I don’t, I said I want to work smart not hard,” Rinomato recalled of the conversation 22 years later.

The friend suggested instead of selling java, she get her real estate license. And just like that, she did. She began her real estate career in a prestigious area of Etobicoke, noting she got lucky getting into the industry at a time when the market was good.

In a sink or swim industry, Rinomato quickly established herself, relying on her people skills, especially during open houses.

“It was really a great learning experience to do open houses and get face-to-face with people because let’s face it, everybody loves to talk about real estate,” she said, adding those open houses taught her the publics perception of real estate and what the masses considered a good home.

By 2006, Rinomato’s success and personality eventually led her to being cast in the popular HGTV show Property Virgins.

For seven seasons, Rinomato crisscrossed the continent coaching first-time homebuyers through the process of buying a home.

When she left the show in 2011, she starred in another HGTV show Buy Herself for one season.

The series focused on single women who were buy their first home.

Rinomato was blindsided by the success of Property Virgins, admitting when she was originally asked to take part, she wondered why anyone would want to watch a show about her day-to-day job.

“The show was watched by five-year olds and 80-year olds. That was a real trip,” she said.

While Rinomato considers her turn on TV a blessing, it was also a lot of work. By 2016, she was feeling burned out and ready to take a

step away from media. Nowadays, she’s focused on her first love:

Real estate. She’s still busy running her successful real estate brokerage Sandra Rinomato Realty Inc., But time away from the tube has allowed Toronto resident to get her life back.

“I’m just really enjoying being a realtor, and being a person,” she said, noting she even has time to meet with girl friends for a weeknight dinner, something she could never fit in around her TV schedule.

Rinomato recently took some time to chat with Our House Magazine about some of her favourite topics including real estate, the current market and women’s empowerment.

Our House:

What is it about real estate that you love?

Sandra. I love that every day is different, every client is different, every property is different, every negotiation is different, I love the people contact and I feed off their energy. And I do love being able to share my knowledge and expertise with people. Because when I go to a professional, I know I really benefit when they are knowledgeable.

What are some of the key pieces of advice you give to a client, especially a first-time homebuyer when you meet them for the first time?

The most important thing is to communicate and be honest. That includes being honest with yourself and create a little bit of a plan. Understand your plan might go off the rails at some point, but if you have a plan you can proceed toward your goal. It’s not easy buying a place, it almost doesn’t matter what your budget is, it’s not easy to find everything you want or everything you’re dreaming about. Recognize that this is a big deal. This is serious and this affects your life. If you’re not prepared for it, chances are you’re going to just give up and rent.

Q: What are the common mistakes you see from people buying a home?

A: First time buyers don’t understand the financing. They go online and do a preapproval online and think, ‘Oh, I can get this much money because I make this much money.’ That’s not a preapproval. And if you do get a preapproval from a lender, it may have conditions, so you have to pay off your credit card or your student loans… and a lot of people make the mistake of not taking that seriously and then shopping and finding out too late they have to have that stuff before they can get the mortgage. The other mistake with first-time buyers especially, they expect to get their forever home right of the gate, but you have to take one step at a time. You may not want to, but in Toronto or Vancouver, the first step is a condo. People really may want a house, and you know what, you can get there. Get the condo, get used to the culture around budgeting and being a homeowner and build equity in the condo… and then you can move up. Another mistake people make, many people, don’t know that mortgages are products and there are many products, there are many things to consider other than the interest rate. For example, don’t assume you’re going to get a 25 year amortization. Talk to your mortgage professional to see what your options are.

Q: What do you make of the real estate market right now in Canada and where do you think its heading?

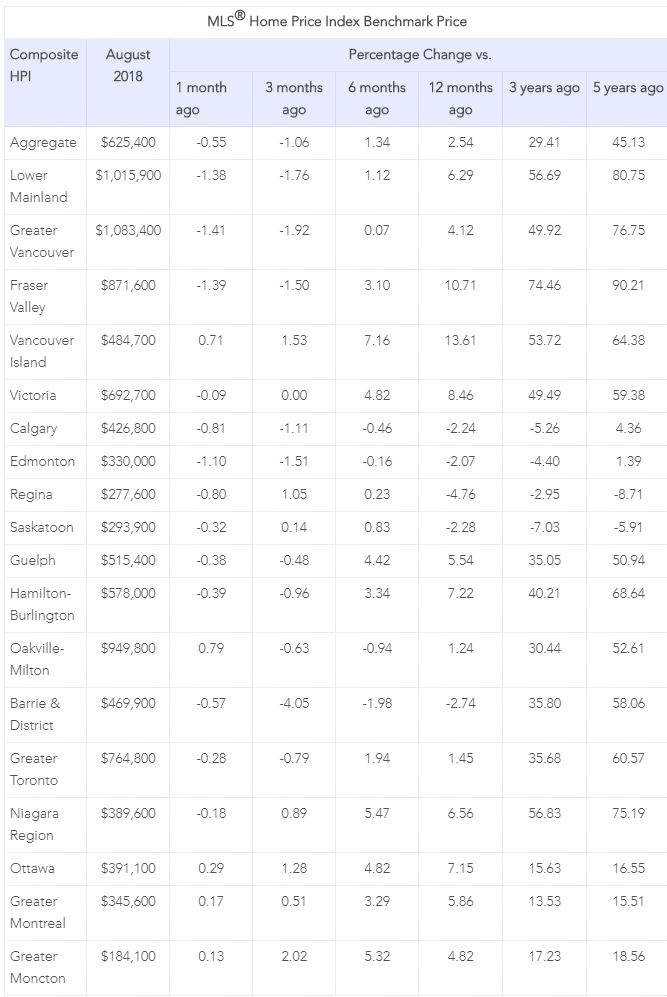

A: I can tell you what’s going on in Toronto, and Toronto is a mixed bag. It has every market. Condos are outperforming every other type of real estate. They are busy, the prices have gone up significantly just in the last six months because it is the last frontier, the last affordable product people can buy. Toronto grew up and I know in Vancouver people are raising families in condos and that’s what’s happening in Toronto. There’s no negative stigma that should be attached to that. The Toronto core, we really didn’t see any hesitation at all. For some reason, the peripheral or outlying areas were hard hit, and I don’t know why. I can’t make sense of it. Many properties are not selling in multiple offers, they’re lingering on the market. I’m going on statistics, I ran the statistics for my area around the office and we’re only four per cent up from last year, but we’re not 40 per cent don like people seem to want to believe. In the last three months it’s gone up eight percent. That little blip is over and I think we’ve come through the other side unscathed. The problem here with Toronto is infrastructure, there’s land that could be developed but there isn’t any money to build the water treatment plants, so the land can’t be developed yet. Even with what’s happening in the peripheral of Toronto with the downturn in the market, that is temporary because people need a place to live and we’re growing rapidly. If you think Toronto is expensive now, just wait.

Q: Have you kept an eye on the mortgage rules that came into effect in January?

A: Yes, people qualify for less. I feel bad for people who waited to have their 20 per cent down because as I said it’s a lot of work, it’s a lot of time to save those after tax dollars and you wanted to avoid the CMHC fees for being a high ratio mortgage. Now you’re in a conventional mortgage and they slap these rules on you and it’s like ‘Wow, I can afford $150,000 less’ which puts you right out of the market. I don’t disagree they should have a stress test to make sure people can afford houses, I think Canadian banks and lenders have been typically conservative and it’s worked well for our country. I do think there should be a little bit of leeway, for people who have to renew in a couple years who may not qualify under the stress test when they have to renew their mortgage. I’m not sure what that’s going to look like. I have clients who are worried and I’m worried for them.

Q: How important is financing and budgeting when it comes to buying a home?

A: It’s crucial. It’s not just a matter of the bank saying I can have this much money. I say calculate what you spend by tracking every penny you spend for a month. Whatever your fixed expenses are, and then anything you buy, either put it on debit or credit so you get a transaction report at the end of the month. If you just look at that and say, this is what I spent, these are my fixed costs, on top of that I have to put on vacation, gifts, entertainment not incorporated in that month… and then savings. Add in 10 per cent of your income or whatever you designate as your savings, and that’s how much money you need every month to survive. When you look at that, you freak out. That’s the real number. Of course you need to know what the bank will give you, but you also need to know what your spending habits are. Don’t lie to yourself, and say you’re going to stop spending money on such and such. If that’s what makes you happy and motivates you to get out of bed, you’re not going to stop. Accept it and embrace it. And so it means I can afford this amount of mortgage. That’s what it means.

Q: How do you see the role of a mortgage broker in the transaction of a home?

A: They’re critical. I don’t have any bearing on where people go, I make my recommendations, only because I know we may need to contact someone on a Saturday night if we’re in multiple offer. We need correct information, and sometimes if you just walk into a (bank) branch you don’t necessarily get a mortgage professional, so I insist they get a mortgage professional.

Jeremy Deutsch

Communications Advisor

There is a lot of misinformation floating around about credit bureaus, credit reports and credit scores – not only that, but a large amount of the clients I work with have never even seen their credit report or score before!

There is a lot of misinformation floating around about credit bureaus, credit reports and credit scores – not only that, but a large amount of the clients I work with have never even seen their credit report or score before!