The CHIP Reverse Mortgage as your Debt Consolidation Solution

Canadians are choosing to carry more and more debt

For many Canadians, borrowing money has become an increasingly necessary means of keeping up with ongoing expenses. Whether it’s a traditional mortgage to get into a home, a line of credit to cover a major purchase or unexpected expense, or credit cards to pay monthly bills, many Canadians find themselves plagued by a high debt load at one time or another.

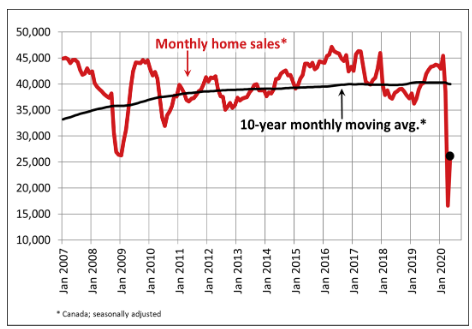

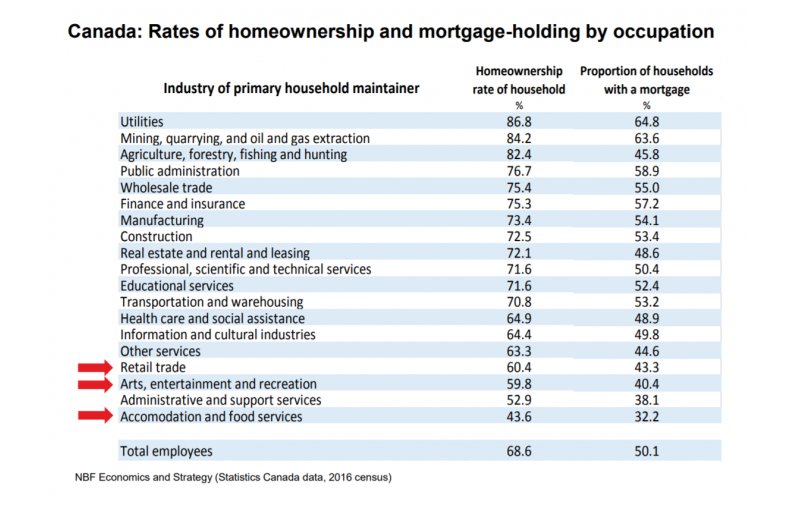

A high debt load is often caused by more than just spending or saving habits. Climbing costs of living combined with a slowing economy have further tightened many Canadians’ cash flows. The reality of the COVID-19 situation is that many Canadians will need to increase their debt to cover their monthly expenses, but there are no-payment options available to help them manage and consolidate these debts while increasing their cash flow at the same time.

Why consolidate your debts?

It can be a stressful experience to manage debt from multiple sources. With varying interest rates, due dates, and payment methods, many Canadians become overwhelmed by the sheer effort of keeping up with their debt’s demands. That’s why debt consolidation is such a popular strategy: It makes paying down the debt much more efficient and manageable by rolling multiple high-interest debts into a single sum with lower interest and reduced minimum payments. It helps you get out of debt faster and protect your credit score.

But with so many different debt consolidation solutions available, it can be difficult to decide which option is best for you.

The reverse mortgage advantage

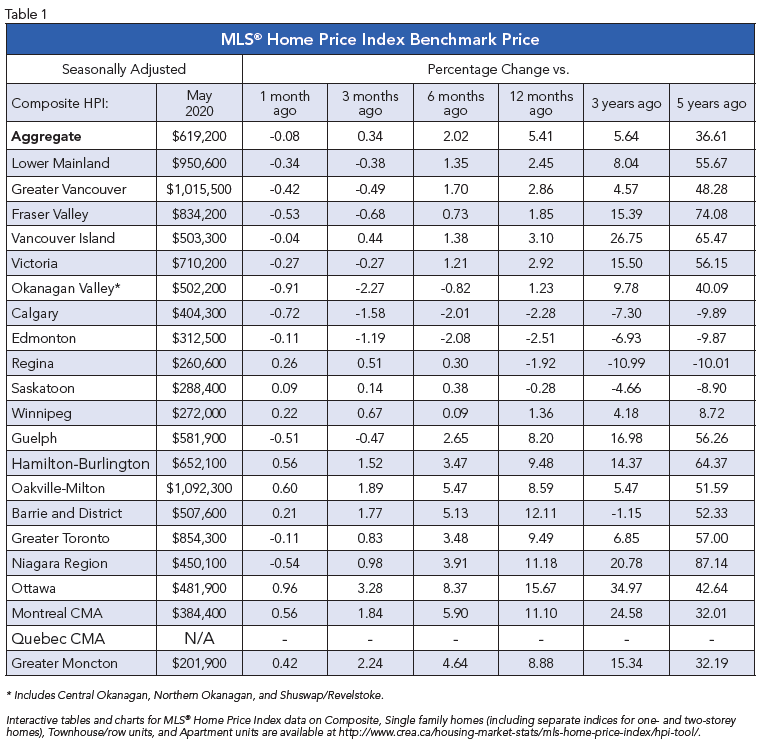

For 55+ Canadian homeowners, a reverse mortgage is a great option to consolidate debt, especially during retirement. In these uncertain times, where investments and the economy have taken a major hit, many retirees will experience a monthly “income gap” where taking on additional debt is the most accessible option to cover the difference. And while retirees may have trouble increasing their income in retirement, the equity held in their home can be leveraged to consolidate their debts into one loan.

If you are a Canadian 55+ and own your home, the CHIP Reverse Mortgage® from HomeEquity Bank could be an excellent option for you. You can get up to 55% of the value of your home in tax-free cash (either lump sum or planned advances), and with a reverse mortgage, the interest rates are a fraction of what you pay with the average credit card. For these reasons, a CHIP Reverse Mortgage presents a fantastic debt consolidation opportunity – but there’s another major benefit to the reverse mortgage you may want to consider…

Say “So long” to making monthly payments

The CHIP Reverse Mortgage frees you from the burden of having to make monthly payments or interest payments until you decide to sell your home (or if you and your spouse pass away). Without these ongoing monthly payments, you’ll be free to focus on what really matters in retirement: Making the most of your daily life by doing what you love, with those you love.

For 55+ Canadian retirees, there’s only one debt consolidation solution that minimizes accumulating debt, reduces financial stress, and increases disposable income without having to make monthly payments or sell or lose ownership of your home: The reverse mortgage.

Want to know more about using the CHIP reverse mortgage as a debt consolidation tool? Contact your DLC Mortgage Broker for more information.

Posted by: Agostino Tuzi

National Partnership Director, Mortgage Brokers

HomeEquity Bank